Young Researcher Paper Award 2023

🥇Winners

🥇Winners

Print: ISSN 0914-4935

Online: ISSN 2435-0869

Sensors and Materials

is an international peer-reviewed open access journal to provide a forum for researchers working in multidisciplinary fields of sensing technology.

Online: ISSN 2435-0869

Sensors and Materials

is an international peer-reviewed open access journal to provide a forum for researchers working in multidisciplinary fields of sensing technology.

Tweets by Journal_SandM

Sensors and Materials

is covered by Science Citation Index Expanded (Clarivate Analytics), Scopus (Elsevier), and other databases.

Instructions to authors

English 日本語

Instructions for manuscript preparation

English 日本語

Template

English

Publisher

MYU K.K.

Sensors and Materials

1-23-3-303 Sendagi,

Bunkyo-ku, Tokyo 113-0022, Japan

Tel: 81-3-3827-8549

Fax: 81-3-3827-8547

MYU Research, a scientific publisher, seeks a native English-speaking proofreader with a scientific background. B.Sc. or higher degree is desirable. In-office position; work hours negotiable. Call 03-3827-8549 for further information.

MYU Research

(proofreading and recording)

MYU K.K.

(translation service)

The Art of Writing Scientific Papers

(How to write scientific papers)

(Japanese Only)

is covered by Science Citation Index Expanded (Clarivate Analytics), Scopus (Elsevier), and other databases.

Instructions to authors

English 日本語

Instructions for manuscript preparation

English 日本語

Template

English

Publisher

MYU K.K.

Sensors and Materials

1-23-3-303 Sendagi,

Bunkyo-ku, Tokyo 113-0022, Japan

Tel: 81-3-3827-8549

Fax: 81-3-3827-8547

MYU Research, a scientific publisher, seeks a native English-speaking proofreader with a scientific background. B.Sc. or higher degree is desirable. In-office position; work hours negotiable. Call 03-3827-8549 for further information.

MYU Research

(proofreading and recording)

MYU K.K.

(translation service)

The Art of Writing Scientific Papers

(How to write scientific papers)

(Japanese Only)

Sensors and Materials, Volume 33, Number 9(1) (2021)

Copyright(C) MYU K.K.

Copyright(C) MYU K.K.

|

pp. 3053-3068

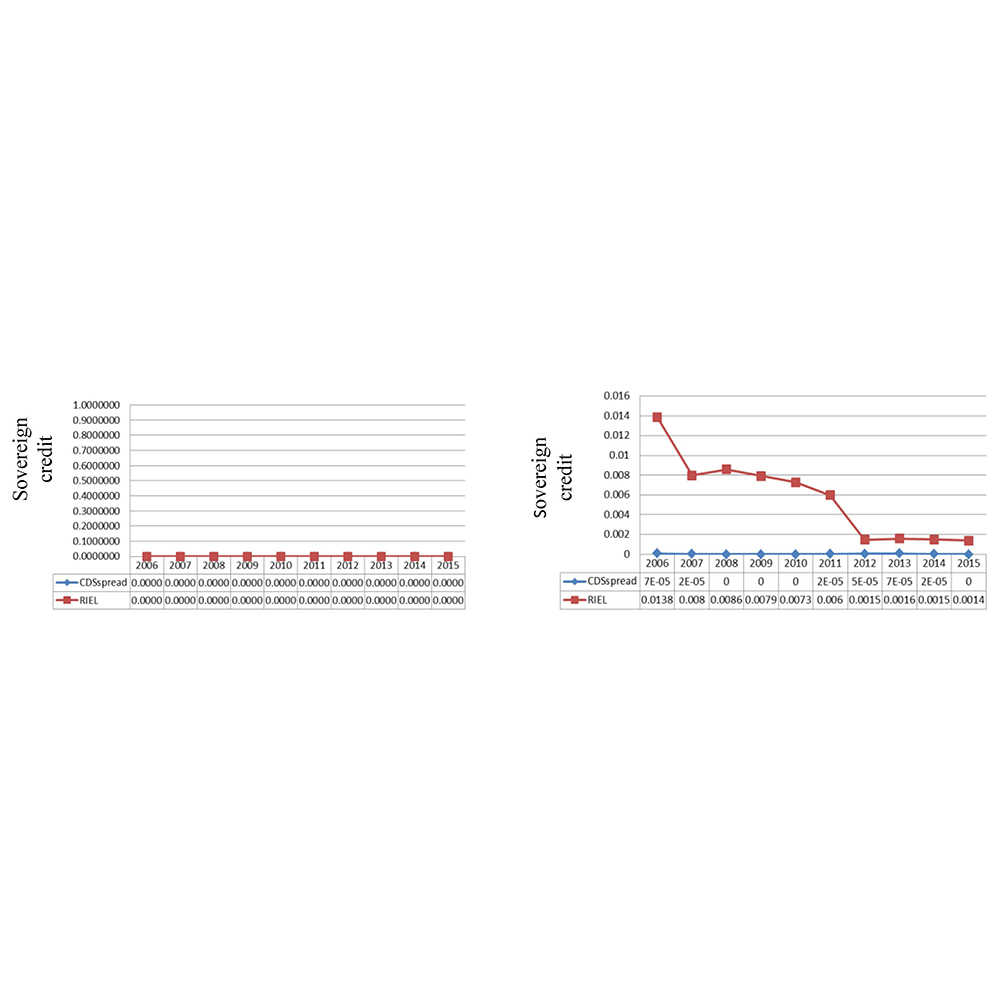

S&M2673 Research Paper of Special Issue https://doi.org/10.18494/SAM.2021.3244 Published: September 10, 2021 Prediction of Sovereign Credit Risk Rating Using Sensing Technology [PDF] Chen-Ying Yen, Yi-Ling Ju, Shih-Fu Sung, Yu-Lung Wu, and En-Der Su (Received December 31, 2020; Accepted August 24, 2021) Keywords: Internet of Things (IoT), CDS spread, sovereign credit rating

In recent years, the study and application of sensor technology have expanded from the industrial to the commercial, financial, and even medical fields. In Taiwan, many studies link sensor technology and the Internet of Things (IoT) with commercial finance, and research on their applications to commercial financial warning or company management is being conducted. The cross-discipline integration of IoT and finance has advanced through the diversification of IoT, and that is why the financial service industry will use IoT as a service platform to provide cross-disciplinary integration services. After exchanging and collecting information by using sensors and handheld devices, it helps to develop new business models such as supply chain financial services to share and manage networks. This enables the financial industry to have a more comprehensive and different understanding of customers and enterprises, which can help the financial industry explore different business opportunities. The aim of this study is to use IoT technology to perform real-time analysis of treasury bill big data and to apply the principles behind sensing to predict and analyze the probability of international defaults in order to reduce investment risks and estimate the credit default swap (CDS) spread. We will then compare the results for the macroeconomic variables with the results of relevant analyses on indicators. The results of the correlation analysis show that the CDS spread and the ratio of the current account balance (CAB) to the gross domestic product have a negative correlation with the gross domestic product growth (GDPG) rate. It has a positive correlation with the inflation rate (INF), the ratio of government debt to gross domestic product (DEBT), and the industrial production index annual growth rate (IPIG). Therefore, the result and the rating-implied expected loss (RIEL) are the same as those in the relevant analysis results of these five macroeconomic indicators. It was also found that IoT technology can be used in the real-time analysis of large-scale treasury bill data, and the principle of sensing can be applied to predict and analyze the accuracy of international defaults.

Corresponding author: Shih-Fu Sung  This work is licensed under a Creative Commons Attribution 4.0 International License. Cite this article Chen-Ying Yen, Yi-Ling Ju, Shih-Fu Sung, Yu-Lung Wu, and En-Der Su, Prediction of Sovereign Credit Risk Rating Using Sensing Technology, Sens. Mater., Vol. 33, No. 9, 2021, p. 3053-3068. |

Forthcoming Regular Issues

Forthcoming Special Issues

Applications of Novel Sensors and Related Technologies for Internet of Things

Guest editor, Teen-Hang Meen (National Formosa University), Wenbing Zhao (Cleveland State University), and Cheng-Fu Yang (National University of Kaohsiung)

Call for paper

Special Issue on Advanced Data Sensing and Processing Technologies for Smart Community and Smart Life

Guest editor, Tatsuya Yamazaki (Niigata University)

Call for paper

Special Issue on Advanced Sensing Technologies and Their Applications in Human/Animal Activity Recognition and Behavior Understanding

Guest editor, Kaori Fujinami (Tokyo University of Agriculture and Technology)

Call for paper

Special Issue on International Conference on Biosensors, Bioelectronics, Biomedical Devices, BioMEMS/NEMS and Applications 2023 (Bio4Apps 2023)

Guest editor, Dzung Viet Dao (Griffith University) and Cong Thanh Nguyen (Griffith University)

Conference website

Call for paper

Special Issue on Piezoelectric Thin Films and Piezoelectric MEMS

Guest editor, Isaku Kanno (Kobe University)

Call for paper

Special Issue on Advanced Micro/Nanomaterials for Various Sensor Applications (Selected Papers from ICASI 2023)

Guest editor, Sheng-Joue Young (National United University)

Conference website

Call for paper

-

For more information of Special Issues (click here)

-

Special Issue on Advanced Micro/Nanomaterials for Various Sensor Applications (Selected Papers from ICASI 2024)

- Accepted papers (click here)

- A Prototype Portable Voltammetric Sensor for Determining Titratable Acidity of Sake and Moromi

Akira Kotani, Kokoro Taniguchi, Koichi Machida, Kazuhiro Yamamoto, and Hideki Hakamata - PACKTEST for L-Glutamate Quantification: Development of On-site and High-throughput Analytical Kits using L-Glutamate Oxidase Mutant

Keita Murai, Hiroki Yamaguchi, Satoru Furuuchi, Kazutoshi Takahashi, Uno Tagami, Moemi Tatsumi, Toshimi Mizukoshi, Hiroshi Miyano, Shuntaro Okauchi, and Masayuki Sugiki - Development of Portable Multi-fluorescence Detection System Using Indium Tin Oxide Heater for Loop-mediated Isothermal Amplification

Ryo Ishii, Sota Hirose, Shoji Yamamoto, Kazuhiro Morioka, Akihide Hemmi, and Hizuru Nakajima - Reproduction of Absorption Spectra of Bromothymol Blue–Methyl Red Mixed Indicator from RGB and L*a*b* Color Coordinates and Application to Fast Spectrum Acquisition

Yusuke Kimura, Arinori Inagawa, and Nobuo Uehara - Orthogonality of α-Sulfoquinovosidase in Human Cells and Development of Its Fluorescent Substrate

Ryosuke Yoshida, Ryosei Kaguma, Ryosuke Kaneko, Ichiro Matuso, Makoto Yoritate, Go Hirai, Takamasa Teramoto, Yoshimitsu Kakuta, Kosuke Minamihata, Noriho Kamiya, Teruki Nii, Akihiro Kishimura, Takeshi Mori, and Yoshiki Katayama

- A Prototype Portable Voltammetric Sensor for Determining Titratable Acidity of Sake and Moromi

- Accepted papers (click here)

- Healthcare System from Multisensor Collaboration and Human Action Recognition

Hongwei Gao, Xuna Wang, Zide Liu, and Yueqiu Jiang

- Healthcare System from Multisensor Collaboration and Human Action Recognition

Guest editor, Sheng-Joue Young (National United University)

Conference website

Call for paper

Special Issue on Asia-Pacific Conference of Transducers and Micro-Nano Technology 2024 (APCOT 2024)

Guest editor, Guangya ZHOU (National University of Singapore) and Chengkuo LEE (National University of Singapore)

Conference website

Call for paper

Special Issue on Sensing and Information and Communication Technologies toward Non-intrusive, Undisturbed, and Calm Healthcare Monitoring

Guest editor, Kosuke Motoi (Shizuoka Institute of Science and Technology)

Call for paper

Special Issue on Innovative Approaches to Forest Monitoring Using Sensing Techniques

Guest editor, Heesung Woo (Kangwon National University)

Call for paper

Special Issue on Sensor for Society

Guest editor, Arinori Inagawa (Utsunomiya University), Yukiko Moriiwa (Tokyo University of Pharmacy and Life Sciences), and Atsushi Shoji (Tokyo University of Pharmacy and Life Sciences)

Call for paper

Special Issue on Materials, Devices, Circuits, and Analytical Methods for Various Sensors (Selected Papers from ICSEVEN 2023)

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Mu-Chun Wang (Minghsin University of Science and Technology), Shih-Hung Lin (Chung Shan Medical University), Ja-Hao Chen (Feng Chia University)

Special Issue on Materials, Devices, Circuits, and Analytical Methods for Various Sensors (Selected Papers from ICSEVEN 2024)

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Mu-Chun Wang (Minghsin University of Science and Technology), Shih-Hung Lin (Chung Shan Medical University), Ja-Hao Chen (Feng Chia University)

Conference website

Call for paper

Special Issue on Sensing and Data Analysis Technologies for Living Environment, Health Care, Production Management, and Engineering/Science Education Applications (2023)

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Rey-Chue Hwang (I-Shou University), Ja-Hao Chen (Feng Chia University), Ba-Son Nguyen (Lac Hong University)

Special Issue on Sensing and Data Analysis Technologies for Living Environment, Health Care, Production Management, and Engineering/Science Education Applications (2024)

Guest editor, Chien-Jung Huang (National University of Kaohsiung), Rey-Chue Hwang (I-Shou University), Ja-Hao Chen (Feng Chia University), Ba-Son Nguyen (Lac Hong University)

Call for paper

Special Issue on 2D Materials-based Sensors and MEMS/NEMS

Guest editor, Kazuhiro Takahashi (Toyohashi University of Technology)

Call for paper

Special Issue on Biosensing Technology Using Micro- and Nanostructures

Guest editor, Kazuhiro Morioka and Atsushi Shoji (Tokyo University of Pharmacy and Life Sciences)

Call for paper

Special Issue on Advanced Sensors Materials and Processes

Guest editor, Shih-Chen Shi (National Cheng Kung University) and Tao-Hsing Chen (National Kaohsiung University of Science and Technology)

Call for paper

Special Issue on Advanced Sensing Technologies for Green Energy

Guest editor, Yong Zhu (Griffith University)

Call for paper

Special Issue on Spatial Information and Digital Twins for Built Environment Development

Guest editor, Dong Ha Lee (Kangwon National University), Myeong Hun Jeong (Chosun University), Jaekang Lee (Dong-A University), Jisoo Park (Indiana State University), and Sungjin Kim (Hanbat National University)

Call for paper

Special Issue on Mobile Computing and Ubiquitous Networking for IoT Society

Guest editor, Takuya Yoshihiro (Wakayama University) and Shigemi Ishida (Future University Hakodate)

Call for paper

Special Issue on Intelligent Sensing and Analysis for Human–Machine Interaction in Healthcare, Biomedical Engineering, and Human-Centered Industrie

Guest editor, Dalin Zhou (University of Portsmouth), Jiahui Yu (Zhejiang University), Yuichiro Toda (Okayama University), and Zhaojie Ju (University of Portsmouth)

Call for paper

Special Issue on Multisource Sensors for Geographic Spatiotemporal Analysis and Social Sensing Technology

Guest editor, Prof. Xiang Lei Liu (Beijing University of Civil Engineering and Architecture) and Prof. Bogang Yang (Beijing Institute of Surveying and Mapping)

Call for paper

Special Issue on Geomatics Technologies for the Realization of Smart Cities

Guest editor, Prof. He Huang (Beijing University of Civil Engineering and Architecture) and Prof. Junxing Yang (Beijing University of Civil Engineering and Architecture)

Call for paper

Special Issue on New Functions of Micro/Nanomaterials and Devices

Guest editor, Takahiro Namazu (Kyoto University of Advanced Science)

Call for paper

Special Issue on Smart Sensing Approaches for Low Carbon, Energy-efficient Manufacturing Processes

Guest editor, Cheng-Chi Wang (National Sun Yat-sen University)

Call for paper

Special Issue on Smart Sensors for Chemical and Agriculture Applications

Guest editor, Kazuaki Sawada (Toyohashi University of Technology)

Call for paper

- Accepted papers (click here)

Copyright(C) MYU K.K. All Rights Reserved.